If the Hilton Head Island-Bluffton Chamber of Commerce wants to keep getting 30% of tourism taxes automatically allocated its way on the island, it will need to submit its financial statements to an audit each year, according to a new contract with the Town of Hilton Head Island.

This article was originally posted by The Island Packet. Click Here to go to the original.

The contract, which the chamber and town council members have been negotiating for nearly a year, will be discussed by the council on Wednesday at its regular meeting.

But its requirement of an audit is no line-by-line breakdown of how tax dollars are spent by the chamber. And it’s also not completely new.

The chamber acted as the official destination marketing organization for the town via a “handshake agreement” for several years before beginning a contract with the town in 2015, according to Town Manager Steve Riley and former Mayor David Bennett. The chamber already produces a yearly audit.

The most recent formal contract was designed after more than a year of complaints from the public that records of the chamber’s spending of around $2 million in tax dollars aren’t available for inspection.

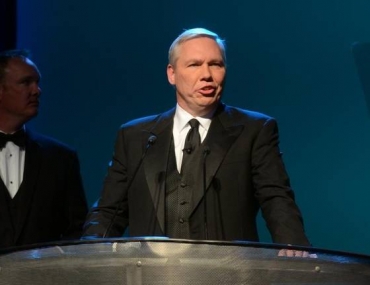

When Bennett and other town council members suggested the chamber submit quarterly receipts for the tax money, chamber President and CEO Bill Miles said the chamber could not divulge its “secret sauce,” that is, what it pays for marketing services and advertising in national media outlets such as Travel + Leisure and Condé Nast Traveler.

The release of the proposed contract comes as Travel + Leisure published four articles by two authors about Hilton Head’s culture and history, golf, hiking, and its accessibility to Savannah. The travel magazine received $50,000 from the chamber this year for “native content” advertising or paid feature stories.

The dispute between Hilton Head and the chamber is important because the chamber is responsible for making sure tourism thrives on the island. Tourism is among Beaufort County’s largest industries, bringing in $1.48 billion.

Hilton Head, the Town of Bluffton and Beaufort County provide 40% of the chamber’s $8.2 million marketing budget, but without an accounting of its spending, it’s hard to tell how successful the marketing effort is.

WHAT WILL BE REQUIRED OF THE CHAMBER

As the contract stands, it requires a financial statement audit, not a forensic or fraud audit, to be submitted each fall by the chamber. The contract will be in place for five years if approved.

Since the chamber is the destination marketing organization, it is entitled by state law to 30% of the accommodations taxes collected on the island each year, which it must use for marketing. It also is eligible for supplemental grants from the tax pool and the emergency reserve fund.

In the past year, the chamber received $500,000 in supplemental tax grants, $175,000 in one-time emergency marketing grants after Hurricane Dorian threatened the island, and $1.95 million in accommodations taxes. The chamber requested $470,000 for coronavirus marketing in May before rescinding its request.

The new contract, which was negotiated by the chamber and town council members Tom Lennox and David Ames, is up for discussion Wednesday and will be voted on by the council twice this month. If there are no major changes and the contract is approved, it is slated to go into effect Dec. 1.

“Just as it did with the last contract, we believe it sets clear parameters and metrics for results for all involved. We’ve always provided to the town details on how we invest these visitor-generated marketing dollars and the results of those efforts. The contract simply formalizes that process,” Miles said.

Here are some of the specifics of what the audit will be required to show:

- Destination Marketing Organization (DMO) revenue, which includes only the 30% accommodations tax fund allocated by the town. Chamber revenue and DMO revenue are separate, as DMO responsibilities are a separate arm of the chamber.

- Hilton Head’s 30% allocation of taxes must be shown separately from any other revenue of the chamber or revenue from any other source, including the Town of Bluffton and Beaufort County.

- All DMO expenses made from the town’s 30% allocation must be shown separately from expenses of the chamber of any other revenue.

The auditing firm also must perform three other examinations of the chamber’s expenses, the contract says:

- A random sampling of 100% of all payments equal to or greater than $10,000

- A random sampling of 55% of all payments equal to or greater than $5,000

- A random sampling of 2% of all payments less than $5,000

The auditing firm will not issue an assurance or opinion on the samplings.

In addition to the audit, the new contract requires the chamber to file tax returns with the town each year that show its total revenue.

Public comments on the proposed contract can be submitted online on the town’s open town hall portal.